Personal property tax in Missouri is an essential aspect of taxation that affects individuals and businesses alike. It is a levy imposed on movable assets owned by taxpayers, and understanding its intricacies is crucial for compliance. Whether you're a resident or a business owner, this tax plays a significant role in funding public services and infrastructure within the state.

Missouri's personal property tax system has been a cornerstone of the state's revenue structure for decades. It ensures that all tangible personal property, such as vehicles, boats, and equipment, contributes to the financial health of local governments. However, navigating the complexities of this tax can be challenging, especially for those unfamiliar with the process.

In this article, we will delve into the details of personal property tax in Missouri, exploring its purpose, calculation methods, exemptions, and more. By the end, you will have a clear understanding of how this tax impacts you and how to manage it effectively.

Read also:Gi Hun Height In Feet A Comprehensive Guide To The Squid Game Star

Table of Contents

- Introduction to Personal Property Tax

- What is Personal Property Tax?

- Key Components of Personal Property Tax

- How Personal Property Tax is Calculated

- Exemptions and Relief

- Filing Process

- Common Misconceptions

- Impact on Businesses

- Tips for Reducing Property Tax

- Frequently Asked Questions

Introduction to Personal Property Tax

Personal property tax in Missouri is a critical component of the state's revenue generation strategy. It applies to movable assets owned by individuals and businesses, ensuring that these assets contribute to public funding. Understanding the basics of this tax is essential for compliance and financial planning.

Why is Personal Property Tax Important?

This tax serves as a vital source of income for local governments in Missouri. The funds collected are used to finance public services such as schools, roads, and emergency services. Without this tax, the state would face significant challenges in maintaining essential infrastructure and services.

Who is Subject to Personal Property Tax?

Residents and businesses that own tangible personal property are required to pay this tax. This includes vehicles, boats, machinery, and other movable assets. The tax applies regardless of whether the property is used for personal or business purposes.

What is Personal Property Tax?

Personal property tax refers to the tax levied on movable assets owned by individuals and businesses. Unlike real estate taxes, which apply to land and buildings, personal property tax focuses on tangible items that can be relocated. In Missouri, this tax is assessed annually and is based on the assessed value of the property.

Types of Personal Property Subject to Tax

- Vehicles, including cars, motorcycles, and trucks

- Boats and watercraft

- Business equipment and machinery

- Furniture and fixtures

Key Components of Personal Property Tax

Several factors contribute to the calculation and application of personal property tax in Missouri. Understanding these components is crucial for accurate compliance.

Assessment Process

The assessment process involves determining the value of the taxable property. This is typically done by local assessors who evaluate the current market value of the assets. The assessed value is then used to calculate the tax owed.

Read also:Noel Tolvanen Vermillion South Dakotas Rising Hockey Star

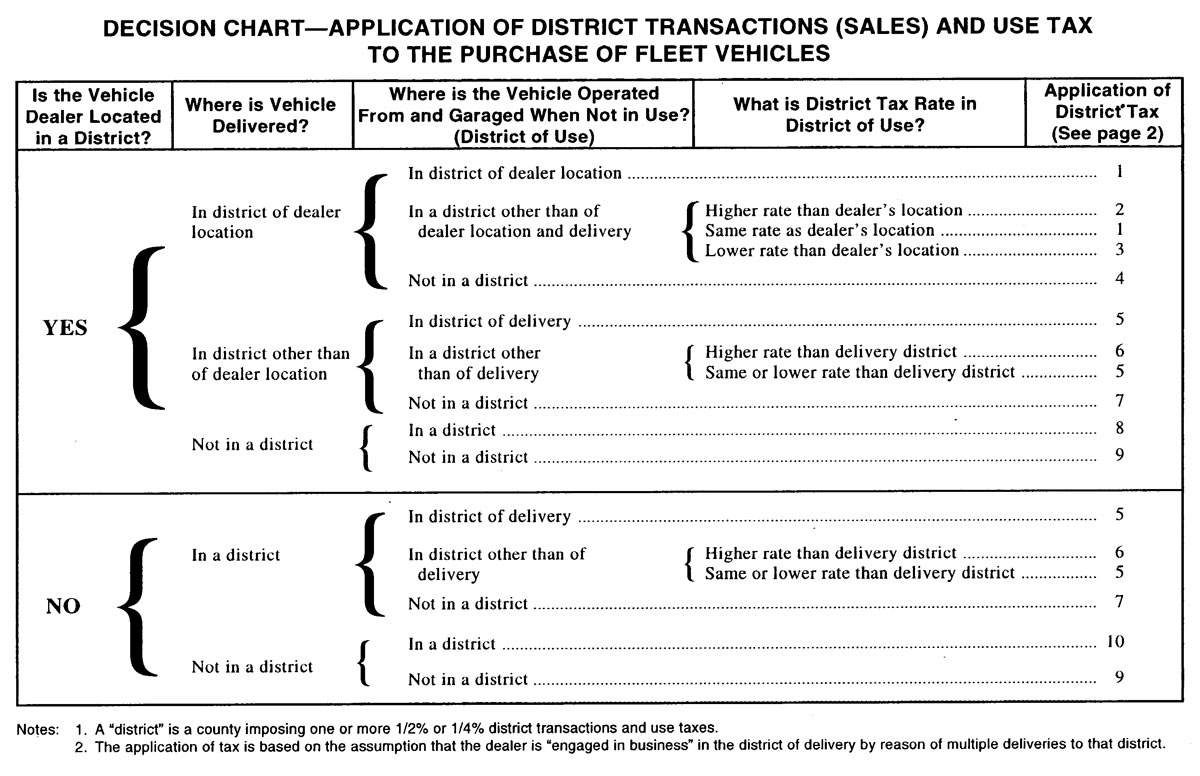

Tax Rates

Tax rates for personal property vary across Missouri's counties and municipalities. These rates are set by local governments and are based on the needs of the community. It is important to note that tax rates can change annually, so staying informed is essential.

How Personal Property Tax is Calculated

The calculation of personal property tax involves several steps. First, the assessed value of the property is determined. This value is then multiplied by the applicable tax rate to arrive at the total tax owed.

Example Calculation

Suppose you own a vehicle with an assessed value of $10,000, and the local tax rate is 2%. The calculation would be:

Assessed Value ($10,000) x Tax Rate (2%) = Tax Owed ($200)

Exemptions and Relief

Missouri offers several exemptions and relief programs for personal property tax. These programs aim to alleviate the financial burden on certain groups, such as low-income individuals and veterans.

Common Exemptions

- Homestead exemption for primary residences

- Veteran's exemption for service members and their families

- Senior citizen exemption for eligible individuals

Filing Process

The filing process for personal property tax in Missouri involves submitting a tax return to the local assessor's office. This return must include detailed information about the taxable property and its assessed value.

Deadlines

It is crucial to adhere to the filing deadlines set by your local government. Missing these deadlines can result in penalties and interest charges. Most counties require returns to be submitted by December 31st of each year.

Common Misconceptions

There are several misconceptions surrounding personal property tax in Missouri. Addressing these misconceptions can help taxpayers better understand their obligations and rights.

Myth: Personal Property Tax Only Applies to Vehicles

While vehicles are a significant component of personal property tax, the tax also applies to other movable assets such as boats, machinery, and furniture. Taxpayers should ensure that all applicable property is included in their filings.

Impact on Businesses

Businesses in Missouri are subject to personal property tax on their equipment and inventory. This tax can have a significant impact on operational costs and financial planning. Understanding the implications is crucial for effective business management.

Strategies for Managing Business Property Tax

- Regularly review and update property inventories

- Utilize available exemptions and relief programs

- Engage with tax professionals for guidance and support

Tips for Reducing Property Tax

There are several strategies taxpayers can employ to reduce their personal property tax burden. These strategies involve leveraging available exemptions, challenging assessments, and optimizing property usage.

Challenging Assessments

If you believe your property has been overvalued, you have the right to challenge the assessment. This process involves presenting evidence to support your claim and working with local authorities to resolve the issue.

Frequently Asked Questions

Here are some common questions about personal property tax in Missouri:

Q: What happens if I fail to pay my personal property tax?

A: Failure to pay personal property tax can result in penalties, interest charges, and potential legal action. It is crucial to address any outstanding tax obligations promptly.

Q: Can I appeal my personal property tax assessment?

A: Yes, you can appeal your assessment if you believe it is inaccurate. The appeal process involves submitting evidence to support your claim and working with local authorities to resolve the issue.

Conclusion

Personal property tax in Missouri is a vital component of the state's revenue generation strategy. By understanding its purpose, calculation methods, and available exemptions, taxpayers can effectively manage their obligations and reduce their financial burden. We encourage you to explore the resources provided in this article and take action to ensure compliance.

We invite you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our site for further insights into taxation and financial management.